Understanding your 401(k) statement doesn't require a finance degree. This guide will empower you to confidently navigate your retirement savings. We'll break down each section, providing clear explanations and actionable steps.

1. Account Summary: Your Retirement at a Glance

This section offers a bird's-eye view of your retirement savings. It shows your total account balance, contributions (your deposits), and gains (investment growth). This is your current retirement snapshot. Are you on track to meet your goals?

- Action: Compare your current balance against your retirement goals. Feeling overwhelmed? Reach out to your HR department or a financial advisor for guidance.

2. Asset Allocation: Where Your Money is Working

This section visually represents your investment mix (like a pie chart). Each slice shows the percentage allocated to different investments (stocks, bonds, etc.). Diversification—spreading your investments across various asset classes—is key to managing risk. Younger investors may tolerate more risk than those nearing retirement.

- Action: Review your asset allocation. Does it reflect your risk tolerance and time horizon? A financial professional can help you adjust it if needed. Remember, some risk is inherent in investing.

3. Investment Performance: Tracking Your Growth

This section tracks your investments' performance over time, showing gains or losses as percentages. Remember, short-term fluctuations are normal; long-term trends are more important.

- Action: Analyze your investment performance. Are the results in line with your expectations? If not, consider adjustments to your portfolio, but remember past performance doesn't guarantee future returns.

4. Fees and Expenses: Knowing What You're Paying

Fees, such as administrative and management fees, reduce your returns. Carefully examine these charges.

- Action: Scrutinize your fees. Are they reasonable compared to similar plans? High fees can significantly impact your long-term growth. Consider switching investments if fees are excessively high.

5. Year-to-Date Summary: Your Annual Retirement Progress Report

This section summarizes your 401(k) activity for the year, including contributions, investment gains/losses, and other key data.

- Action: Review your year-to-date summary. Did your contributions meet your savings goals? Did your portfolio perform as expected? This offers valuable insights into your annual progress.

6. Projected Retirement Income: A Glimpse into the Future (If Available)

Some statements provide a projected retirement income, but remember, it's an estimate, not a guarantee. Many factors can impact your actual income.

- Action: Review the projection (if available). Does it meet your retirement expectations? If not, increase contributions or consult a financial planner for personalized advice.

How to Compare Different 401(k) Investment Options

Understanding your options within your 401(k) is crucial for maximizing your returns.

Decoding Your Investment Choices

Your statement lists your investments and their performance, allowing you to compare options effectively. Don't just focus on current value; consider past performance, risk, and fees.

- Step 1: Identify each fund's name and asset allocation.

- Step 2: Analyze their returns over different timeframes. Look for consistent growth and alignment with your risk profile.

- Step 3: Compare fees (expense ratios). Small differences can accumulate significantly over time.

- Step 4: Ensure your investments are diversified across various asset classes.

Key Takeaway: Comparing 401(k) investment options requires considering long-term growth, risk, and fees. A balanced approach is key.

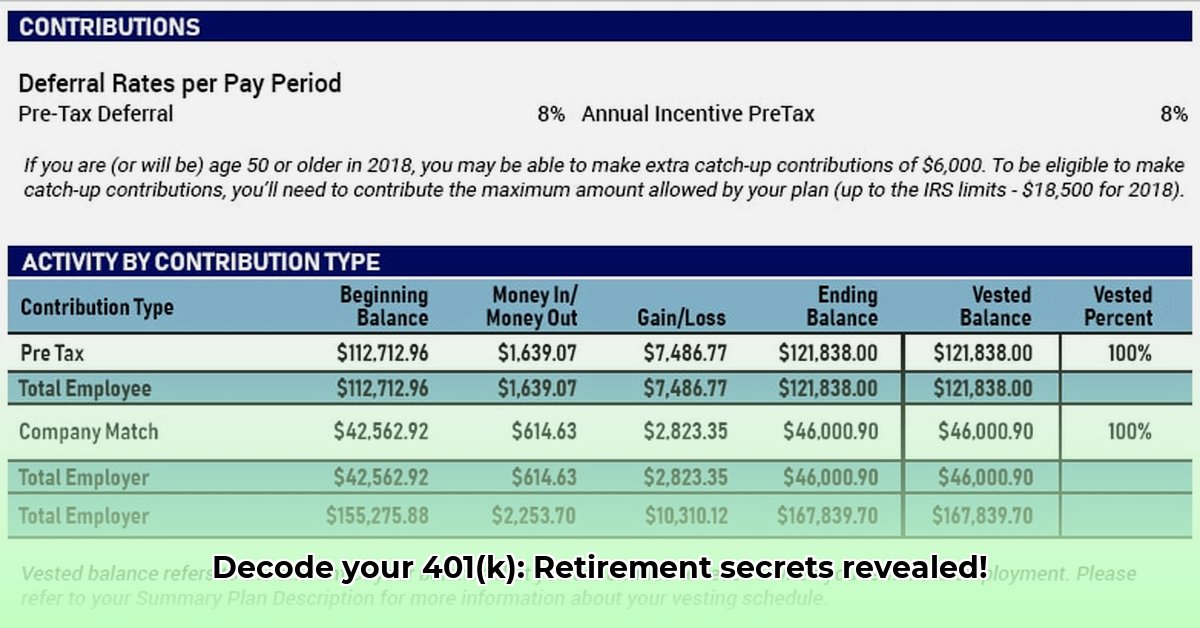

Understanding Contributions and Employer Match

Maximize your employer's match – it's free money!

- Step 1: Verify you're contributing enough to get the full match.

- Step 2: Understand the tax implications of pre-tax and after-tax contributions.

Account Balances and Growth

Monitor your account balance and long-term growth trends, remembering that short-term market fluctuations are normal.

- Step 1: Track your account balance, which reflects your current retirement assets.

- Step 2: Pay attention to long-term growth trends rather than short-term market volatility.

Actionable Steps & Monitoring Progress

Regularly reviewing your 401(k) statement is essential for making informed decisions and staying on track toward your retirement goals.

Key Takeaways:

- Regularly review your 401(k) statement.

- Compare investment options carefully, considering long-term performance, risk, and fees.

- Maximize your employer's match.

- Consult a financial advisor for personalized guidance.